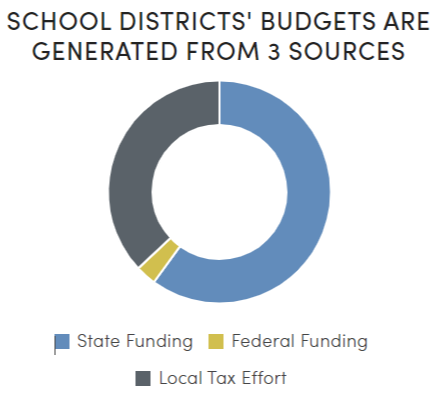

SCHOOL FINANCE:

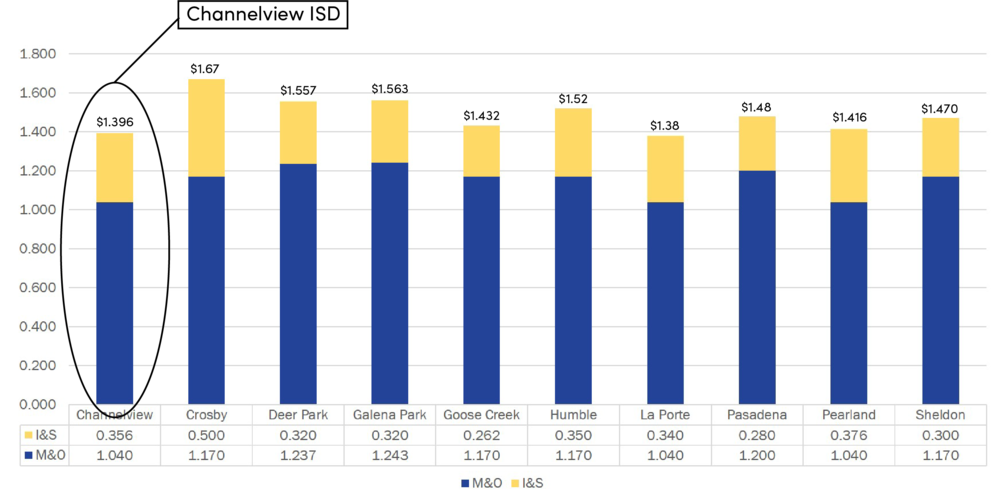

The local tax efforts for public schools involve two figures:

MAINTENANCE & OPERATIONS (M&O), used to pay salaries, utilities, furniture, supplies, food, gas, etc. For the average citizen, this is similar to house repairs, car fuel, groceries, cleaning supplies, utilities, etc.

INTEREST & SINKING (I&S), used to repay debt for the construction and renovation of facilities, the acquisition of land and the purchase of equipment, technology and transportation. For the average citizen, this is similar to a new home purchase, home renovations, land purchase, new kitchen appliances, etc.

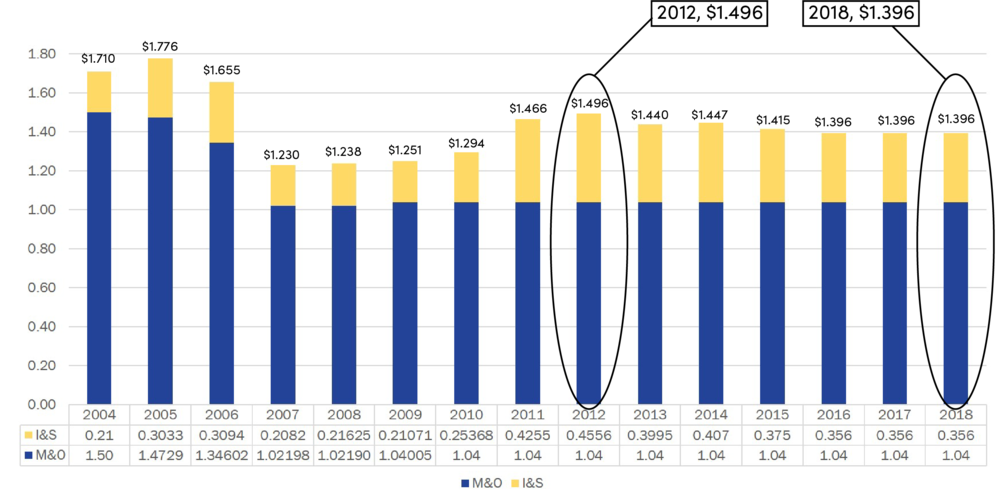

The M&O tax rate is capped at $1.04 per $100 of property value. The $1.04 cap does not require voter approval. The I&S tax rate is capped at $0.50 per $100 of property value. Every cent of the $.50 cap requires voter approval in a bond election.

Bond elections only affect the I&S tax rate. I&S funds cannot, by law, be used to pay M&O expenses, which means that

voter-approved bonds cannot be used to increase teacher salaries or pay rising costs for utilities and services.

SCHOOL DISTRICTS' BUDGETS ARE GENERATED FROM 3 SOURCES